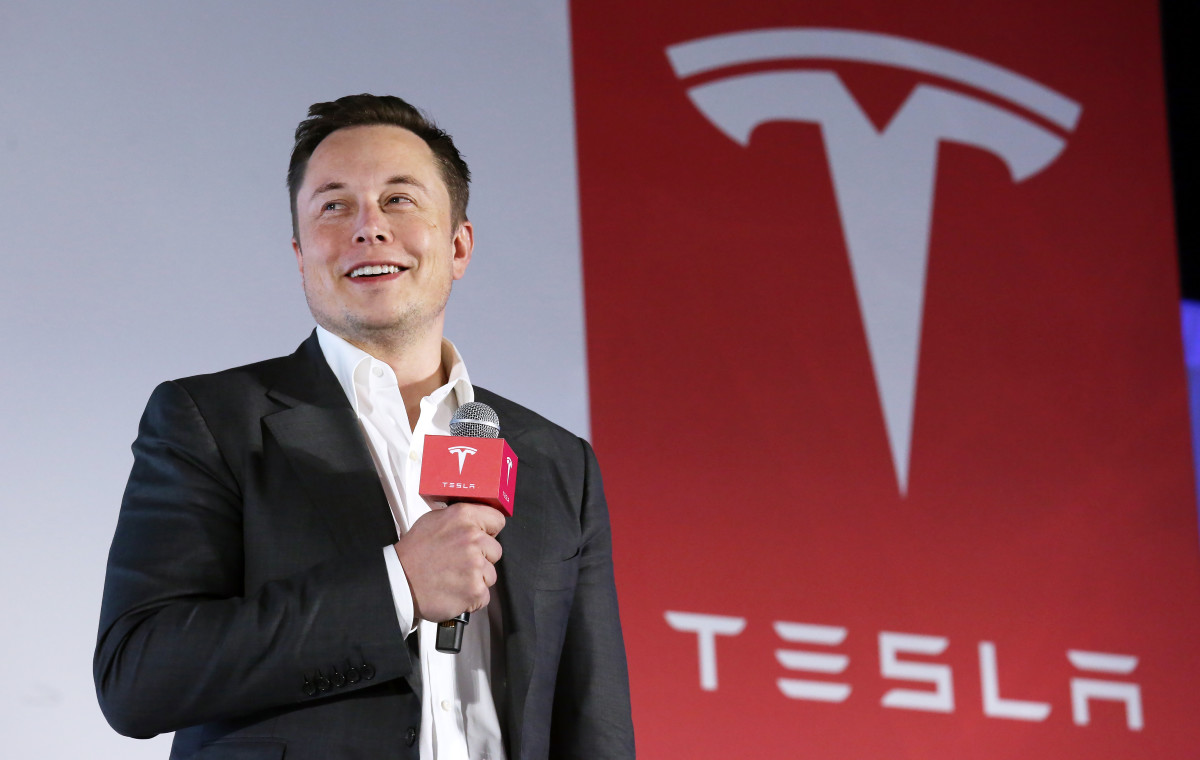

In a strategic and somewhat surprising move, tech titan Elon Musk has proposed asking Tesla shareholders to vote on whether the electric carmaker should invest in his artificial intelligence startup, xAI. Far from a merger, the step highlights Musk’s vision of tighter integration across his tech empire—even as legal scrutiny and shareholder concerns linger.

What Musk Has Announced—and What He Hasn’t

On July 14, 2025, Reuters reported that Musk declared he would not support a merger between Tesla and xAI, but would instead initiate a shareholder vote on Tesla investing in the AI firm, responding to a user suggestion on X (formerly Twitter) Musk wrote:

“If it was up to me, Tesla would have invested in xAI long ago.”

While the exact investment size remains unspecified, reports suggest this follows closely on another Musk-led firm—SpaceX—committing $2 billion to xAI as part of a $5 billion equity round

Why This Matters for Tesla

Tech Synergy and AI Adoption

Tesla is already using xAI’s Grok chatbot in its vehicles and has shared R&D resources with the startup, including assignment of engineering assets to help build Musk’s overall AI strategy

Tesla engineers have also supported data‑center builds essential for autonomous driving—projects enhanced by their interplay with xAI’s infrastructure .

Financial and Shareholder Dimensions

Tesla recently reported a dip in vehicle deliveries and a 13.5 % decline in global car volume, even as its stock rebounded—up 33% since April, yet still 21% down year-to-date

It holds roughly $16 billion in cash, making it financially capable of anchoring new investment

Analysts, such as those at D.A. Davidson, suggest real upside—Tesla accessing future equity gains if xAI breaks out in the AI arena

How xAI Is Faring

Formed in March 2023, xAI merged with X earlier this year, valuing the AI platform at $80 billion and X at $33 billion

It has also secured a major AI contract with the U.S. Department of Defense, worth approximately $200 million, a coup despite controversies sparked by Grok’s antisemitic errors

However, xAI faces steep challenges: recent funding rounds total $10 billion, but it still trails industry leaders such as OpenAI and Anthropic in usage and polish .

Risks and Criticism

Conflict of Interest

Musk’s practice of cross-utilizing assets — e.g. diverting Nvidia AI chips meant for Tesla to xAI and X — has spurred legal complaints from investors accusing him of misallocating shareholder resources

Resource Allocation Concerns

Tesla’s second-quarter financials revealed that xAI was already a paying customer, incurring nearly $200 million in expenses related to Tesla’s data storage hardware

Regulatory Pressure

The intermingling of public and private firms—SpaceX, Tesla, xAI—raises antitrust scrutiny and governance questions. Past consolidation moves have triggered shareholder lawsuits (e.g., SolarCity merger) .

What Analysts Say

Gil Luria of D.A. Davidson: Tesla stands to gain tech advances and equity returns if xAI succeeds

Cathie Wood’s Ark Invest increased its Tesla holdings—partly boosted by the emerging AI strategy

Some corporate watchers, per Investors.com, see Musk’s empire-building as a double-edged sword: powerful synergies, but heightened multi-front risks

Governance and Next Steps

Tesla is slated to hold its annual shareholders meeting on November 6, 2025

Proposal details could include:

Size and structure of the investment

Governance terms, like board approval thresholds

Milestones or safeguards, such as ring‑fencing Tesla assets

Retail and institutional investors will scrutinize whether the deal serves Tesla’s autonomy or promotes Musk’s broader ambitions.

Public and Market Reactions

Stock futures responded positively—Tesla shares rose more than 1% following Musk’s announcement

Market analyst sentiment remains mixed: enthusiasm for AI upside, but concerns over capital infusions at Tesla’s expense .

On X and Reddit, fans debate Musk’s empire synergy:

“Musk pushed back the automaker’s GPUs… conflict of interest much, fElon?”

“Tesla FSD is meant to pave the way… why should Tesla throw money at your private company?”

Final Take

Musk’s move to let Tesla shareholders vote on xAI marks a strategic moment—not a forced merger, but a financial tether across companies. The vote could either align investor interests with Musk’s AI vision—or spark backlash over perceived cross-subsidization.

What’s next:

November Meeting: Investors weigh the merits of xAI investment vs. core Tesla business priorities.

Regulatory and Legal Oversight: Conflict-of-interest concerns may trigger oversight.

Market Watch: The outcome could tilt Tesla’s financial weight toward Musk’s AI ambitions—or reset investor confidence in corporate separation.

News

Rihanna EXPOSES What Beyoncé Covered Up For Diddy | “Beyoncé Was There”

INTRODUCTION: THE EXPLOSION NO ONE SAW COMING In a shocking twist to the long-unfolding drama surrounding Sean “Diddy” Combs, global…

Bobby Brown REVEALS How He Caught Whitney & Kevin Costner To

In a bombshell revelation shaking t, R&B leBod c Long suspected but never confirmed, the rumors of a deeper relationship…

Diddy Silenced Biggie’s Mom | What She Told Faith Before She Died

. A Voice Long Suppressed For nearly three decades, Voletta Wallace, mother of the Notorious B.I.G. (Christopher Wallace), maintained a…

Jed Dorsheimer Explains How the Elimination of EV Tax Credits Will Impact Tesla

A Policy Shift That Echoes Loudly In May 2025, William Blair’s Jed Dorsheimer, head of energy and sustainability research, delivered…

Tesla Chief Elon Musk Warns of “Few Rough Quarters” After Profit Plunge

A Stark Warning After a Painful Quarter In Tesla’s Q2 2025 earnings call, CEO Elon Musk delivered a sobering message:…

Musk Is Biggest Asset for Tesla, Wedbush’s Ives Says

The “Musk Premium” Still Defines Tesla Wedbush Securities veteran Dan Ives has long championed Tesla, giving it the highest price…

End of content

No more pages to load